How To Calculate The Straight Line Method Of (For) Depreciation (Schedule Or Table) Explained

In this video we go through how to calculate depreciation using the straight line method for depreciation and how to do a depreciation schedule using the straight line method

Transcript/notes

The straight line method for depreciation tries to distribute the same amount of expense to each period of time.

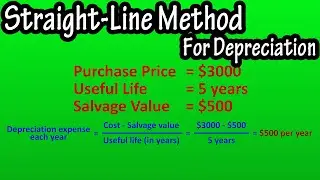

Let’s say that a company purchases a piece of equipment for $3000 and applies the straight line method for depreciation. What is the depreciation schedule?

To do this, we must know 3 things, the purchase cost of the equipment, the useful life of the equipment or asset, and the residual or salvage value of the equipment. Salvage value is the amount the company expects to receive at the end of the useful life of the equipment or asset.

For our example, the useful life is 5 years, and the salvage value is $500.

The formula for depreciation expense for the straight line method is, depreciation expense each year equals, the cost minus the residual or salvage value, divided by, the useful life in years.

Plugging into the formula, we have, $3000 minus $500, the salvage value, divided by 5 years. And this calculates to $500 as the depreciation expense each year.

Now we can create a depreciation schedule. And we are going to put 4 columns in it, end of year, depreciation expense for year, accumulated depreciation at end of year, and the book value at end of year.

For the end of year column, this is simply 1, 2, 3, 4, and 5, for the 5 years of useful life of the asset. For the second column, depreciation expense for year, each of these is $500, as we calculated a moment ago, there will be a $500 depreciation expense each year.

For the third column, accumulated depreciation at end of year, this is the total amount of depreciation accumulated at the end of each year. So, at the end of year 1, the total amount of depreciation will be $500. At the end of year 2, the accumulated depreciation will be the depreciation for year 1 and year 2, so, $500 plus $500, which is $1000. At the end of year 3, the accumulated depreciation will be the depreciation for year 1 plus year 2, plus year 3, so, $500 plus $500, plus $500, which is $1500. And at the end of year 4, it will be $2000, and after year 5 it will be $2500.

Now for the last column, the book value at end of year. This is the original cost of the asset minus the accumulated depreciation at the end of the year. So, the book value at the end of year 1 will be the original cost of $3000 minus the accumulated depreciation at end of year 1, $500. Which equals $2500. At the end of year 2, we have $3000 minus the accumulated depreciation at end of year 2, $1000, which equals $2000. And here are the other book values for years 3, 4, and 5.

In the end the book value after the last year of useful life, in this example year 5, should match the salvage value we started with, and it does, as it is $500.

Here is another example, with an original cost of $22,000, a useful life of 8 years and a salvage value of $3000.

Chapters/Timestamps

0:00 What is the straight line method for depreciation?

0:16 What is salvage value?

0:23 Example for straight line method for depreciation

0:37 Formula for depreciation for straight line method

1:03 Create a schedule/table for straight line method for depreciation

1:35 How to calculate accumulated depreciation at end of year

2:17 How to calculate book value at end of year

3:02 Another example