Country Risk: Determinants, Measures, and Implications (FRM Part 2 – Book 2 – Credit Risk – Ch 8)

For FRM (Part I & Part II) video lessons, study notes, question banks, mock exams, and formula sheets covering all chapters of the FRM syllabus, click on the following link: https://analystprep.com/shop/unlimite...

AnalystPrep is a GARP-Approved Exam Preparation Provider for FRM Exams

For all other courses, including CFA, actuarial, and graduate admission products, click here: https://analystprep.com/courses/

After completing this reading, you should be able to:

Identify and explain the different sources of country risk.

Evaluate the methods for measuring country risk and discuss the limitations of using those methods.

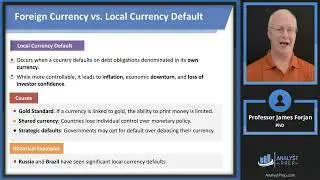

Compare and contrast foreign currency defaults and local currency defaults.

Explain the consequences of a country's default.

Discuss measures of sovereign default risk and describe components of a sovereign rating.

Describe the shortcomings of the sovereign rating systems of rating agencies.

Compare the use of credit ratings, market-based credit default spreads, and CDS spreads in predicting default.