Measuring Credit Risk (FRM Part 1 2025 – Book 4 – Chapter 6)

For FRM (Part I & Part II) video lessons, study notes, question banks, mock exams, and formula sheets covering all chapters of the FRM syllabus, click on the following link: https://analystprep.com/shop/unlimite...

AnalystPrep is a GARP-Approved Exam Preparation Provider for FRM Exams

After completing this reading, you should be able to:

Evaluate a bank’s economic capital relative to its level of credit risk.

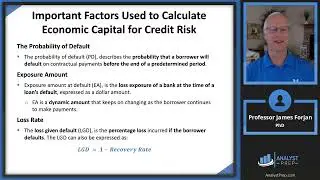

Explain the distinctions between economic capital and regulatory capital, and describe how economic capital is derived. Identify and describe important factors used to calculate economic capital for credit risk: the probability of default, exposure, and loss rate.

Define and calculate the expected loss (EL).

Define and explain unexpected loss (UL).

Estimate the mean and standard deviation of credit losses assuming a binomial distribution.

Describe the Gaussian copula model and its application.

Describe and apply the Vasicek model to estimate default rate and credit risk capital for a bank.

Describe the CreditMetrics model and explain how it is applied in estimating economic capital.

Describe and use the Euler’s theorem to determine the contribution of a loan to the overall risk of a portfolio.

Explain why it is more difficult to calculate credit risk capital for derivatives than for loans.

Describe challenges to quantifying credit risk.

0:00 Introduction

1:18 Learning Objectives

2:18 Distinction between Economic Capital and Regulatory Capital

9:38 Unexpected Loss

20:38 Mean and Standard Deviation of Credit Losses

24:03 The Gaussian Copula Model

28:08 One-Factor Correlation Model

36:56 Credit Metrics Model

39:36 Euler's Theorem

45:28 Credit Risk Capital for Derivatives