Credit Scoring and Retail Credit Risk Management (FRM Part 2 2025 – Book 2 – Chapter 15)

For FRM (Part I & Part II) video lessons, study notes, question banks, mock exams, and formula sheets covering all chapters of the FRM syllabus, click on the following link: https://analystprep.com/shop/unlimite...

AnalystPrep is a GARP-Approved Exam Preparation Provider for FRM Exams

After completing this reading you should be able to:

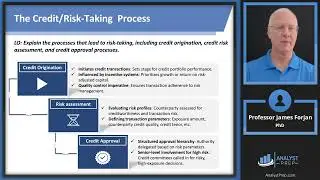

Analyze the credit risks and other risks generated by retail banking.

Explain the differences between retail credit risk and corporate credit risk.

Discuss the “dark side” of retail credit risk and the measures that attempt to address the problem.

Define and describe credit risk scoring model types, key variables and applications.

Discuss the key variables in a mortgage credit assessment and describe the use of cutoff scores, default rates and loss rates in a credit scoring model.

Discuss the measurement and monitoring of a scorecard performance including the use of cumulative accuracy profile (CAP) and the accuracy ratio (AR) techniques.

Describe the customer relationship cycle and discuss the trade-off between creditworthiness and profitability.

Discuss the benefits of risk-based pricing of financial services.

0:00 Introduction

1:24 Learning Objectives

2:13 What is Retail Banking?

3:45 Risks Generated By Retail Banking: Variability in Outcomes

8:59 Retail Credit Risk vs. Corporate Credit Risk

16:07 Measures that Attempt to Address the Dark Side of Retail Credit Risk

18:33 Credit Risk Scoring Models

21:28 Types of Credit Scoring Models

23:56 Key Variables in a Mortgage Credit Assessment

26:10 Cutoff Scores

29:16 Default Rates and Loss Rates

30:32 Measuring and Monitoring the Performance of a Scorecard

36:31 Trade-off between Creditworthiness and Profitability

37:43 Customer Relationship Cycle

40:11 Benefits of Risk-based Pricing of Financial Services