Gold Price News - 13-June-23 - Gold and Silver Spike on US Inflation Slowing Ahead of the Fed

Buy gold, silver, platinum & palladium

0.5% commission & tight spreads

https://www.bullionvault.com

Buy #gold, #silver, #platinum and #palladium bullion online at the lowest possible price

Gold Price News By Adrian Ash - Tuesday 13/06/2023

https://www.bullionvault.co.uk/gold-n...

GOLD and SILVER spiked Tuesday before dropping back to trade unchanged for the week so far after new US data said inflation in the world's largest economy continues to ease from last year's 4-decade highs but remains well above the Federal Reserve's official 2.0% target.

With the Fed's policy committee starting its 2-day June meeting this morning, the headline cost of living on the Consumer Price Index came in 0.1% higher for May from April, half the monthly increase analysts had forecast.

That pulled the 12-month rate of CPI inflation down to 4.0%, the slowest pace since March 2021, according to the Bureau of Labor Statistics' unadjusted series.

So-called 'core' inflation – excluding 'volatile' food and fuel prices – meantime slowed as expected to 5.3% per year, the weakest pace since November 2021 on the BLS data.

Gold spiked over $10 per ounce inside 2 minutes on the inflation data, peaking near the top-end of last week's trading range above $1970 before dropping back to show no change for the week so far around $1960.

Betting that the Fed will 'skip' a rise tomorrow and make no change to overnight interest rates in Wednesday's announcement meantime jumped from 4-in-5 speculative positions to more than 9-in-10, according to the CME derivatives exchange's FedWatch tool.

Market forecasts for the Fed's year-end rate also edged back after the inflation figures, showing a consensus of 5.06% for December – just below current effective Fed Funds rates – after reaching 5.11% yesterday.

That's the same level as the Fed itself predicted for end-2023 interest rates in both last December and then March's quarterly 'dot plot' forecasts, now due to be updated to accompany tomorrow's June decision on monetary policy.

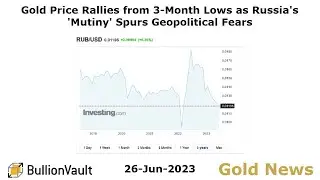

Chart of gold priced in Dollars vs. end-2023 Fed rate forecasts. Source: BullionVault

"Ahead of this week's [Federal Open Market Committee] meeting...and with the receding impact of the debt ceiling issue, gold has traded in a narrow range in low volumes over the past week," says bullion-market analyst Rhona O'Connell at brokerage StoneX.

"Often a low volume market leads to price volatility, but for gold over the past few days it has been more of a case of no-one wanting to take fresh positions in case of a surprise this Wednesday with the release of the Statement from the FOMC and [chairman] Jay Powell's subsequent Press Conference."

Today's swing in the gold price around the US inflation data release was driven primarily by volatility in the Dollar, with the US currency losing 0.5% on its trade-weighted index to hit the lowest in 3 weeks while gold priced in the Euro dropped towards €1813, the bottom of its trading range so far in June.

The European Central Bank is widely expected to announce its 8th consecutive rise to Euro interest rates on Thursday, taking the cost of refinancing operations for commercial banks up to 4.0% per annum.

Consumer-price inflation across the 19-nation currency union last month ran at 6.3% in No.1 economy Germany – the slowest since February 2022 saw Russia begin its invasion of Ukraine – new figures confirmed Tuesday, and slowed near 2-year lows at 2.9% in No.4 Spain.

Silver prices also spiked and fell back on today's US inflation figures, dropping 0.8% for the week so far at $24.10 per ounce.

If the Fed were to raise rates tomorrow – an outcome now backed by less than 6% of futures trading according to the CME – it would in fact be "a dovish hike" says bullion strategist Nicky Shiels at Swiss refining and finance group MKS Pamp, because "counterintuitively" it would bring the US central bank "one step closer to being done and ramps up [the risk of] recession, a Fed policy mistake and financial instability risks."

Crude oil meantime recovered yesterday's plunge towards 18-month lows, recovering to $74 per barrel of Brent, while global stock markets also rose together with government debt prices, edging longer-term borrowing costs lower.