Gold Price News - 29-Jun-23 - Spot Gold Dips Below $1900 as 'Resilient' Data Backs More Rate Hikes

Buy gold, silver, platinum & palladium

0.5% commission & tight spreads

https://www.bullionvault.com

Buy #gold, #silver, #platinum and #palladium bullion online at the lowest possible price

Gold Price News By Adrian Ash - Thursday 29/06/2023

https://www.bullionvault.com/gold-new...

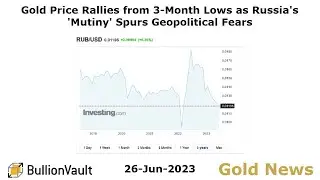

SPOT GOLD prices fell into London's daily benchmark on Thursday, dipping through $1900 for the first time since the eve of March's mini-crisis in US regional banking after new data said the US jobs market remains stronger than expected.

The price of gold then rallied around today's 3pm auction, fixing close to $1900 per Troy ounce before rising another $10 to recover almost all of that earlier 0.9% drop.

Even so, Thursday's dip in gold's spot-market price saw it set a fresh 16-week low at the LBMA Gold Price auction, down 7.2% from mid-April's peak of $2048 – the highest-ever global gold benchmark price outside the first-wave Covid Crisis top of August 2020 – at the lowest since Friday 10 March.

Crashing on the stock market, US lender Silicon Valley Bank was bailed out that weekend, with panic then spreading to other regional lenders and Swiss bank Credit Suisse being taken over by giant rival UBS a week later.

Chart of spot gold priced in US Dollars. Source: BullionVault

"Major central banks are still determined to choke off inflation," says bullion-market analyst Rhona O'Connell at brokerage StoneX, noting the 'hawkish' comments from US, Euro and UK monetary chiefs meeting at this week's ECB Forum in Sintra, Portugal.

"Core PCE [inflation data will then be] released on Friday...a parameter to which the [US] Fed pays very close attention."

Predicted to show annual inflation held at 4.7% per year in May excluding fuel and food, "any surprise to the upside could put fresh pressure on gold," says O'Connell, because "those expectations are [already] baking in bearish views" among financial traders.

Headline inflation in No.1 Eurozone economy Germany today came in ahead of analyst forecasts for June, rising to 6.8% on Destatis' first estimate on the region's 'harmonized' methodology from May's 15-month low of 6.3% per year.

Euro gold prices rebounded in late-afternoon spot trade after falling within €1 per ounce of yesterday's 15-week low of €1740, rising to €1756.

Gold priced in UK Pounds meantime rallied more sharply as Sterling slipped on the currency market, pulling the precious metal £15 per ounce higher from this week's dip through £1500.

Covid, not Brexit, is to blame for the UK suffering the worst inflation among major developed economies in 2023 claimed Bank of England governor Andrew Bailey in Sintra on Wednesday.

"Faced with more persistent inflation, we need a more persistent policy," said the 19-nation Eurozone's ECB president Christine Lagarde meanwhile.

"We will have to bring rates [up] to sufficiently restrictive levels and keep them there for as long as necessary."

Today's US data said the number of people wanting jobless benefits last week was below consensus forecasts for both new and continuing claims, with initial applications dropping the hardest week-on-week since October 2021.

Despite US inflation holding near 4-decade highs as interest rates rise the fastest since 1980, "The US economy has actually been quite resilient," said US Fed chairman Jerome Powell at this week's ECB Forum.

"A recession is certainly possible [but] not the most likely case."

Prices for silver – now finding 1/7th of its physical end-use in PV solar farms and installations – meantime spiked lower with spot gold quotes Thursday afternoon in London. But silver also then rebounded, rallying back to $22.60 per ounce and standing apart from the other precious metals in showing a small gain for the week so far.

Both still finding their largest single use in autocats to reduce harmful emissions from fossil-fuel engine systems, platinum today hit 8-month lows beneath $900 and palladium fell back towards Wednesday's new 54-month low beneath $1220 – barely one-third the record-high price hit as No.1 mining nation Russia was hit by Western sanctions in spring last year over its latest invasion of Ukraine.

Palladium's 4-year low makes it "one of the worst commodity performers year-to-date," says a note from Swiss bullion refining and finance group MKS Pamp, "behind natural gas, which is down 42%.

"Certainly no inflationary signals are stemming from the commodity space."

![[FREE] WONDAGURL TYPE BEAT “BLOIRROOM”](https://images.videosashka.com/watch/em_1W_sa5r8)

![[FREE] VC Barre X ADAAM Type Beat -](https://images.videosashka.com/watch/rxVo6PyKrlU)