Market infrastructure survey launch

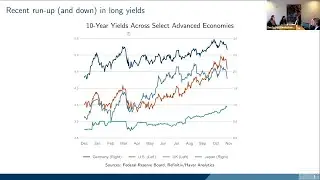

The global bond markets have long been criticised for being inefficient, lacking integration and lagging in the adoption of digitalisation and technology. This is not for lack of effort, as there are fundamental flaws within the process of debt issuance making this burdensome.

To understand these key issues and find solutions, OMFIF’s Sovereign Debt Institute launched its inaugural market infrastructure survey for public sector borrowers, debt capital markets banks, and fixed income investors. The survey sought to investigate the problems with the then-current market infrastructure and how it could be improved using qualitative and quantitative questions. The results were anonymized and presented at an exclusive launch event in December, featuring a panel of leading sovereign, supranational, and agency issuers, banks, investors, and other key market participants in the bond markets.

The results of the survey and launch event formed the basis of a series of market infrastructure workshops in 2024 by OMFIF’s SDI. Workshops, like the green, social, and sustainable series organized since 2021, were off the record, aiming to provide a knowledge-sharing forum for market participants to discuss how to improve the bond issuance process. The workshops explored ways to improve efficiencies in workflow, pre-trade processes, price discovery, book-building, settlement, and looked at the use of digital bonds, blockchain, and more. These workshops brought together a broad range of market participants, including issuers, investors, banks, digital platforms, clearing and settlement houses, consultants, trading platforms, law firms, and others.