Portfolio Risk and Return - Part I (2024/2025 Level I CFA® Exam – PM – Module 1)

Prep Packages for the CFA® Program offered by AnalystPrep (study notes, video lessons, question bank, mock exams, and much more):

Level I: https://analystprep.com/shop/cfa-leve...

Level II: https://analystprep.com/shop/learn-pr...

Levels I, II & III (Lifetime access): https://analystprep.com/shop/cfa-unli...

Prep Packages for the FRM® Program:

FRM Part I & Part II (Lifetime access): https://analystprep.com/shop/unlimite...

Topic 3 – Portfolio Management

Module 1 – Portfolio Risk and Return – Part I

LOS : Describe characteristics of the major asset classes that investors consider in forming portfolios.

LOS : Explain risk aversion and its implications for portfolio selection.

LOS : Explain the selection of an optimal portfolio, given an investor’s utility (or risk aversion) and the capital allocation line.

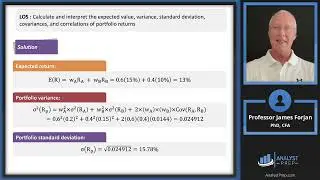

LOS : Calculate and interpret the mean, variance, and covariance (or correlation) of asset returns based on historical data.

LOS : Calculate and interpret portfolio standard deviation.

LOS : Describe the effect on a portfolio’s risk of investing in assets that are less than perfectly correlated.

LOS : Describe and interpret the minimum-variance and efficient frontiers of risky assets and the global minimum-variance portfolio.