Income Tax Calculation| Save Income Tax with Old Tax Regime FY-2023-24 |Deductions in old Tax Regime

Save Income Tax with Old Tax Regime FY-2023-24 |Income Tax Calculation| Deductions in old Tax Regime.

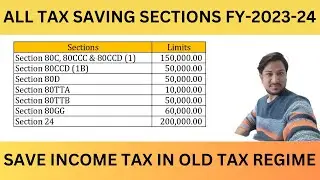

Save Income Tax with all Sections in Old Tax Regime | In this video I will see all sections under income tax act to help you save income with old and new tax regime in hindi. These sections include investments under section 80C, section 80D, section 80CCD(1B), section 24 and many more sections. These options will help you to save income tax with old tax regime and new tax regime.

After watching this video so many queries will be solved:

What are the Income tax saving options

How to Save Income Tax with old tax regime

Deductions allowed in old and new tax regime

Is section 80C allowed in new tax regime

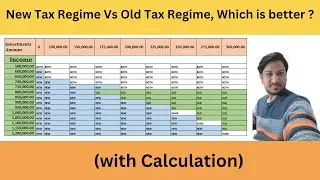

Old vs new tax regime which is better

Income Tax return filing things to know

Deductions in income tax act

Income Tax Calculation 2023-24

Income tax slab rates 2023-24

All deduction sections to save income tax

Income tax slab rates FY-2023-24

Income tax slab rates AY 2024-25

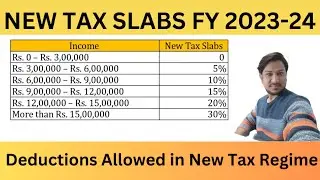

NEW TAX REGIME:

No Income Tax on Income between Rs. 0 to Rs. 3 lacs

5% Tax on Income between Rs. 3 lacs to Rs. 6 lacs

10% Tax on Income between Rs. 6 lacs to Rs. 9 lacs

15% Tax on Income between Rs. 9 lacs to Rs. 12 lacs

20% Tax on Income between Rs. 11 lacs to Rs. 15 lacs

30% Tax on Income above Rs. 15 lacs

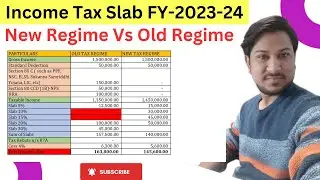

OLD TAX REGIME: -

No Income Tax on Income between Rs. 0 to Rs. 2.5 lacs

5% Tax on Income between Rs. 2.5 lacs to Rs. 5 lacs

20% Tax on Income between Rs. 5 lacs to Rs. 10 lacs

30% Tax on Income above Rs. 10 lacs

How is 80C Calculated? Total Deductions in 80C includes sum of the investments amount made in above mentioned 80C schemes along with Section 80CCC and 80CCD investments. The maximum limit is Rs. 1.5 lacs under Section 80C in a financial year. And additional amount of Rs. 50,000 under Section 80CCD(1B) with NPS – National Pension Scheme

Can you claim Deduction in 80C and 80CCC separately? Not separately, but a total of Rs. 1.5 Lacs can be claimed after combining amounts from both Section. Only Section 80CCD(1B) for NPS investment allows to claim additional Rs. 50,000 apart from Rs. 1.5 Lacs in Section 80C.

Which option in Section 80C has minimum lock in period? ELSS or Equity Linked Saving Scheme is the option that helps you to save income tax under Section 80C with minimum lock in period which is just 3 years. Watch Best ELSS Mutual funds to invest here in this video.

if you want learn about What is GST, How to file GSTR-1.

Please click on given link below:-

GST Course #1 What is GSTR-1, GSTR-2, GSTR-3B,ITC In detail | GST basic to advance sikhe

PART-1 LINK:- • Free GST Complete Course in Hindi|Wha...

Tally Features in GST| GST basic to advance course

PART-2 LINK:- • GST basic to advance course Part-2|| ...

Create sales voucher with multiple Tax rate

PART-3 LINK:- • Tally Prime- Purchase Entry With GST ...

Create Sales Invoice with Multiple GST rate

PART-4 LINK:- • Part-4, Create Sales Invoice with Mul...

GSTR 1 Return Filing online-2023

PART-5 LINK • How to File GSTR 1| GSTR 1 Return Fil...