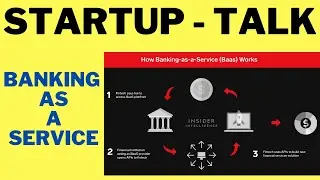

STARTUP TALK EPISODE #28 WHAT IS BANKING AS A SERVICE | FINTECH | BRANDS | BENEFITS | InterviewDOT

STARTUP TALK EPISODE #28 WHAT IS BANKING AS A SERVICE | FINTECH | BRANDS | BENEFITS | InterviewDOT

What is Banking as a Service?

In the banking as a service (otherwise known as BaaS) model, the customer is owned by a non-banking financial services provider which integrates its services with facilities from one or more banks. BaaS is the plug-and-play equivalent offering banking and financial services. BaaS means customers are paying for services as they use them, rather than buying applications. Many finance service and banking providers are now embedding financial services into their offerings to enhance the end-to-end journey for their customers.

https://money-gate.com/banking-as-a-s...

How does banking as a service work?

Banking as a service (BaaS) involves three parties – a Third Party Provider (TPP) which offers a brand of services to end-users; a service provider that supplies modular financial services to TPPs on cost-per-use service; and a registered bank that provides banking functions to service providers, such as payments, back-office operations, risk management, and customer service. Most importantly, the bank is the entity that provides regulatory compliance for the whole BaaS platform.

The bank grants access to its systems to a TPP, which means the TPP can use its APIs to interact with customer data. With this access, the TPP can offer banking products and services using its systems.

BaaS explained

Built on the concept of software as a service (SaaS), which enables users to subscribe to function-specific services over the internet rather than having to buy and install applications on their computers, BaaS is the plug-and-play banking equivalent that enables users to access financial services over the internet. It typically does this through banks offering up their infrastructure to third-party service providers such as financial-technology firms (fintech), that are offering retail banking services, typically through the use of application programming interfaces (APIs).

The list of best online banking platform providers includes new players such as Mambu, 10X, Thought Machine, and FinXact, as well as products from the traditional core platform vendors. These promise to help banks radically modernize and accelerate the benefits through higher developer productivity and the removal of technical hurdles. They can achieve further efficiencies by leveraging cloud-based services, which enable them to deploy new products and scale infrastructure quickly and use development tools that support automation.

Third parties can provide various financial services to their customers by building on top of the existing regulated infrastructure of licensed banks. Service providers from virtually any sector can now incorporate the full range of financial services for their customers and for the customers themselves to conveniently access those financial services even if they are not customers of the underlying bank. With BaaS, service providers can simply pick and mix from a range of financial products and then tailor them to the needs of their customers; in doing so, they can create new financial platforms of their own.

Banking as a Service Providers

Banking as a Service Providers that offer the core banking capabilities and the brand that faces the consumer can be different entities. For example, Grab, which began as a ride-hailing service in Singapore, has embedded payment services and its own wallet into its Uber-like app, so it now also provides e-commerce, mobile and point-of-sale payment services through an API-driven platform. For Grab, the Dutch payment company Adyen, with its own banking license, functions as the license holder.

It has been projected that BaaS currently produces $29 trillion in the e-commerce market and TPPs are producing solutions that offer customers more choice and greater convenience.

This structure is useful for service providers that want to market themselves as being as similar as possible to a licensed bank, with comparable capabilities, offering equivalent services such as current accounts, savings facilities, and debit and credit cards. With BaaS, the payments company offers this range of services without actually having to hold a banking license itself. By engaging with a regulated bank via the BaaS platform, the payments company has the advantage of offering banking products to the public at a lower cost because it saves time and money by not having to obtain the necessary regulatory licenses required to offer certain banking products and services. It can also rely on the technology infrastructure of the bank which frees up time and cost for the payments company to focus on its business strategy.

![TAMIL WHO IS AN INTRPRENEUR ? HOW YOU CAN BECOME AN INTRAPRENEUR [CAREER GROWTH]? SERIES - EPISODE 1](https://images.videosashka.com/watch/CpQHCww_uIg)