Channel 11: Are We There Yet?

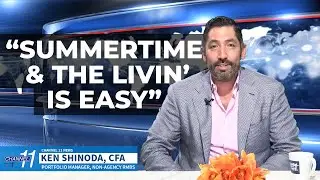

Channel 11 host and DoubleLine Portfolio Manager Ken Shinoda recaps market activity in August, another month in which investors waited and watched for definitive signs of a recession or soft landing. Mr. Shinoda kicks things off with equities (00:26), which are having a big run despite this being touted as the year for bonds earlier in 2023. Topics include the diverse performance of the Magnificent Seven and the S&P 493 (3:14) and interest coverage issues that small companies are facing (5:48). In his fixed income coverage (8:09), Mr. Shinoda looks at what he sees as one of the big value buys out there: U.S. Treasuries, running down factors that could have positive and negative impacts on yields.

This episode, recorded Sept. 6, 2023, concludes with What Looks Cheap (21:52), Agency mortgages and CMBS, and a review of the year-to-date excess return for credit assets (26:10) compared to last year’s rough performance.

![[친절한K] 위상 흔들리는 제주 관광…대변신 위한 조건은? / KBS 2024.12.26.](https://images.videosashka.com/watch/6rwi0YuQ11c)