Update on my YieldMax ETF Test Portfolio

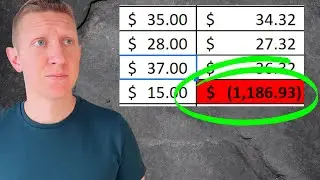

In this video we are talking about the YieldMax ETF's with ultra-high distribution yields and specifically on building a YieldMax ETF Portfolio that then pays for monthly expenses. In this video I am walking through my analysis on which YieldMax ETF's make the most sense based on their historical distributions.

----------------------------------------------------------------------------------------

JOIN THE PATREON COMMUNITY!

➡ / averagejoeinvestor

WANT ACCESS TO ALL OF MY SPREADSHEETS I USE ON THE CHANNEL ALONG WITH THE MONTHLY DIVIDEND STOCK SPREADSHEET AND INSTANT AWARENESS OF CHANGES TO MY PORTFOLIO? JOIN THE PATREON COMMUNITY!

-----------------------------------------------------------------------------------------

➡ / averagejoeinvestor

You can also Work with Joe 1 ON 1!

Want to increase your option selling knowledge and get started!

-----------------------------------------------------------------------------------------

🔴 Partner With Me - [email protected]

-----------------------------------------------------------------------------------------

This communication/content is for informational purposes only and is not intended as personalized investment advice, tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon for purposes of transacting in securities or other investment vehicles.

------------------------------------------------------------------------------------------

Unlike traditional ETFs that might focus on capital appreciation or tracking an index, YieldMax ETFs prioritize delivering regular income, often by selling short-term options. This approach can produce high distribution rates, appealing to income-focused investors, but it comes with trade-offs and risks. These funds don’t invest directly in the underlying stocks or ETFs they’re based on. Instead, they use a combination of U.S. Treasury bills for stability and options (like call spreads) to generate income while capping potential upside gains. For example, a YieldMax ETF tied to a stock like Tesla (TSLY) or Nvidia (NVDY) will offer exposure to that stock’s price movements but limits how much you benefit if the stock surges, while fully exposing you to declines. The income comes primarily from the premiums earned selling these options, influenced heavily by the implied volatility of the underlying security—higher volatility generally means higher premiums and thus higher potential payouts.

The appeal is clear: some YieldMax ETFs boast eye-catching distribution rates, often exceeding 50% or more annually, based on their most recent payouts. For instance, funds like BABO or PLTY have announced distributions translating to over 100% annualized yields as of today, February 26, 2025. However, these rates aren’t guaranteed and can fluctuate wildly month to month—sometimes even dropping to zero—since they depend on market conditions and option pricing. The trade-off is that the net asset value (NAV) can erode over time, especially if the underlying security drops, as the funds don’t fully participate in upward price movements but take the full hit on the downside.

There’s a range of YieldMax ETFs, each with a specific focus. Single-stock funds like MSTY (MicroStrategy) or NVDY (Nvidia) target volatile, popular names, often yielding higher distributions but with greater risk of NAV decline. Broader funds like YMAX, a “fund of funds” holding multiple YieldMax ETFs, aim for diversification and even offer weekly payouts, though with lower per-distribution amounts. Newer offerings, like the Target 12 ETFs (BIGY, SOXY), aim for a steadier 12% annual income target plus some capital appreciation by directly holding stocks alongside options, potentially reducing NAV erosion. Risks are significant. The options strategy means you’re betting on volatility more than growth, and if the market moves against you, losses can outpace income. Expense ratios are also higher than average—most hover around 0.99%, with funds like YMAX at 1.28% due to acquired fund fees—eating into returns. Plus, distributions might include return of capital, not just profits, which can mask underlying performance issues.