GST INPUT AND OUTPUT ADJUSTMENT| GST LIABILITY SET OFF NEW RULES| CALCULATE GST AMOUNT IN EXCEL

GST INPUT AND OUTPUT ADJUSTMENT| GST LIABILITY SET OFF NEW RULES| CALCULATE GST AMOUNT IN EXCEL

For weekly Live Interview Preparation and Test Sessions

📱Join our What's App Group Now (FOR FREE)- Accountant Interview Preparation

https://chat.whatsapp.com/J14eSAklMai...

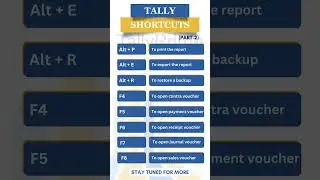

📚 Learn More with Skillshort:

GST, Income Tax, ITR, Accounting, Tally, and TDS Returns

To Join our Courses,

Fill out the Registration Form for online or offline classes

https://forms.gle/pnJLgZbebRfhQvC28

📞 Call or WhatsApp us @ 7878870903

🔗 Stay Connected:

Facebook: / iskillshort

Instagram: / iskillshort

Youtube: / @iskillshort

LinkedIn: / ca-rupa-jain-daga-5278bb208

Explore more about our courses and services.

📱 Download the Skillshort Mobile App:

Stay updated on the go with our mobile app.

👉 Download App- https://play.google.com/store/apps/de...

🌐 Visit Our Website: https://skillshort.com/

Understanding how to leverage GST set-off rules is essential for optimizing your tax efficiency. Let's dive into the fundamentals:

Input Tax Credit (ITC):

Input Tax Credit allows businesses to offset the GST they've paid on inputs (raw materials, goods, or services) against their GST liability on outputs (sales).

Eligible Inputs: Businesses can claim ITC on goods and services used or intended to be used for taxable supplies.

Conditions: To claim ITC, businesses must ensure that the supplier has deposited the GST collected to the government and furnished the required returns.

Set-Off Mechanism:

Businesses can set off the available ITC against their GST liability in a specific order:

a. IGST (Integrated GST) can be set off against IGST, then CGST (Central GST), and finally SGST (State GST).

b. CGST can be set off against CGST and then IGST.

c. SGST can be set off against SGST and then IGST.

Restrictions and Conditions:

Certain restrictions apply to the utilization of ITC:

a. ITC cannot be claimed for goods and services used for personal consumption.

b. ITC cannot be claimed for goods and services used for making exempt supplies.

c. ITC cannot be claimed for specific categories of goods and services as notified by the government.

Transitional Provisions:

Transitional provisions govern the transition from the previous tax regime to GST.

Businesses can claim transitional credits for taxes paid on stock held before the GST rollout, subject to specified conditions.

Documentation and Compliance:

Proper documentation and compliance are crucial for claiming and utilizing ITC effectively.

Businesses must maintain records of all purchases, tax invoices, and other relevant documents to support their ITC claims.

By understanding and adhering to GST set-off rules, businesses can not only minimize their tax liabilities but also ensure compliance with GST regulations. Stay informed, stay compliant, and maximize your tax efficiency with these essential insights!"