DEBIT AND CREDIT NOTE UNDER GST | DEBIT NOTE IN GST | CREDIT NOTE IN GST

Become Accountant at your pace

Monthly Subscription

Rs 199 only,

Yearly Subscription Rs 1499

Topics Covered

Accounts

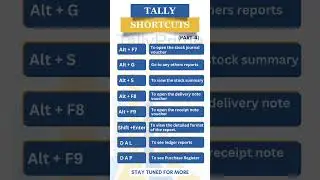

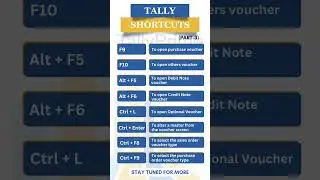

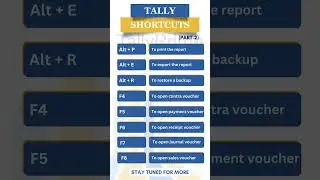

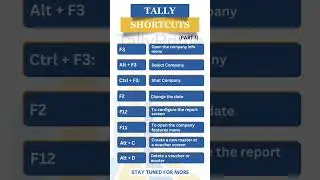

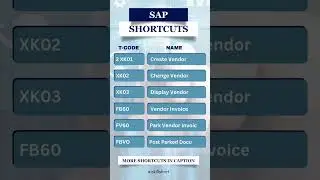

Tally Prime

GST

TDS

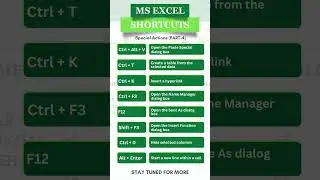

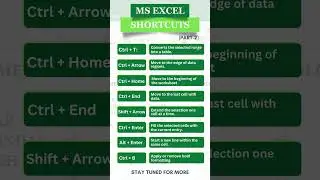

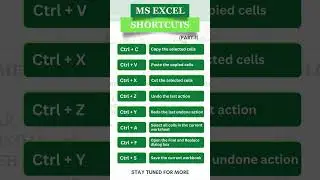

Excel

Other Benefits

Live Doubt Session on a weekly basis.

Test and Assignment

and Job Support as well.

Click the Link and Buy Now

Limited Time Offer Available

https://auhsz.courses.store/214579? For More Update and Tests join our Whats App Community

https://chat.whatsapp.com/HAZk1gvh4ZO... Test Your Accounting Skill

https://bit.ly/3CGycL0

Test Your GST Skill

https://bit.ly/3CGyi5k

Test Your Tally Prime Skill

https://bit.ly/3PVMOck

Test Your Excel Skill

https://bit.ly/3wAWO4d For Online Or Offline Classes

fill the Registration Form

https://forms.gle/pnJLgZbebRfhQvC28

Or WhatsApp Us on 7878870903

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Subscribe to get NEW Tutorials every week at: https://bit.ly/3QUg9oX

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ DEBIT AND CREDIT NOTE UNDER GST | DEBIT NOTE IN GST | CREDIT NOTE IN GST

In this video, we will learn about Debit Note and Credit note under GST. We have taken two situation and various scenarios to explain Debit Note and Credit Note under GST. In case of Situation 1, we have taken seller prospective, where Seller A sold goods to Purchaser B, the purchaser account will be debited in the books of seller. Again, in scenario 1, in case of decrease in value due to sales return or higher amount charge by seller, seller is required to credit the purchaser in his books of accounts and hence will issue credit note. Again, in case of Scenario 2, to increase the value in case of lower amount being charged, seller is required to debit the purchaser and hence the seller will issue debit note. In case of Situation 2, we have taken the purchaser prospective, where purchaser B has purchased goods from seller A, seller A will be credited in the books of B. Again, in Scenario 1, in case of decrease in value, purchase is required to debit the seller, hence issues debit note. Again, in case of Scenario 2, to increase the value, purchase will credit the seller and hence issues credit note. As per GST disclosure in respect of Seller, Credit/ Debit Note is shown in GSTR 1 and in deducted/added in the Sales value in GSTR 3B. Again, in respect of purchaser, it is auto populated in GSTR 2A.

✔Guys, For GSTR 9 detailed video click on the below link

• GSTR 9 ANNUAL RETURN 2020-21 | HOW TO...

✔For Accounting Concept video, click on the below link :-

• ACCOUNTING CONCEPTS | JOURNAL ENTRIES...

✔For GSTR 1 detail video, click on the link below :-

• GSTR 1 RETURN FILING | HOW TO FILE GS...

✔For HOW TO CHANGE MOBILE NUMBER AND EMAIL ADDRESS IN GST PORTAL kindly click on below link

youtube.com/video/coyon5WkG3Q/

✔ For TDS ENTRY IN TALLY PRIME | TDS ENTRY | TDS IN TALLY | TDS, kindly click on below link

youtube.com/video/wOuYrRMI-QM/

✔For TDS | TDS RETURN IN HINDI | HOW TO FILE TDS RETURN | TDS RETURN IN DETAIL, kindly click on below link

youtube.com/video/RZWZXk5plv8/

✔For GSTR 2B | GSTR 2B VS GSTR 2A | GSTR 2B IN HINDI, kindly click on below

linkyoutube.com/video/8HcGR4UijZQ/

✔For Learn Tally Prime in Hindi | Tally Prime full Tutorial | Tally Prime, kindly click on below link

youtube.com/video/bpBy3DFVDUc/

✔For Google Sheets Tutorial In Hindi | How to use Google Sheets | Google Sheets, kindly click on below link

youtube.com/video/7QV1rLNj218/

✔For GST REGISTRTION | GST REGISTRATION PROCESS IN HINDI | HOW TO APPLY FOR GST, kindly click on below link

youtube.com/video/WuT6vTgBuro/

✔For Google Sheets Tutorial In Hindi | How to use Google Sheets | Google Sheets, kindly click below link

youtube.com/video/D9QqhvtzJGM/

✔Follow us on Facebook :- www.facebook.com/iskillshort

✔Instagram :- www.instagram.com/iskillshort

If you have any doubts/ queries, feel free to post your comments in the “Comments Section” and we promise to reach out to you as soon as possible.

You can also mail your doubts/ queries to [email protected]. You can also download the “Skillshort” app from Google Playstore from the following link

Please be patient and watch the complete video to know and understand the complete section in detail.

Do like the video, post your comments, subscribe to our channel and press the

“Bell” icon to receive the latest updates and notifications from our content creators.

#gst #skillshort #credit&debitnoteundergst #cacsrupajaindaga

credit note,what is credit note,debit note and credit note,credit note entry,debit note,difference between debit note and credit note,what is debit note and credit note in accounting,debit credit note,credit note meaning,debit and credit note,credit note definition,debit note vs credit note,credit note journal entry,credit note in gst,what is debit note,credit note format,debit note credit note,credit note explanation,skillshort,ca cs rupa jain daga